This article is intended for people who are making plans to sell online, launched their e-commerce shop or simply would like to take online payments for specific products or services sold over the internet.

By outlining the options, we try to help merchants and businesses in figuring out what would work for them in terms of integration, costs and convenience. By giving the pros and cons, visuals and examples, we can hopefully guide you in the right direction.

Our objective is to allow you to make informed decisions and to prevent you from making choices that turn out to be costly in the short or long term.

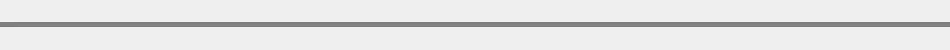

There are 6 ways to accept payments online.

- through the acceptance of bank transfers

- through a direct Integration with a Payment Method or Payment Solution

- through a direct integration with a Payment Service Provider

- through a full service ecommerce platform

- through a marketplace

- through a combination of the above

1. Through the acceptance of bank transfers.

Probably the most easy way of selling online and letting customers pay for goods or services, is by having them transferring money into your bank account. It is as simple as it sounds. Just mention your bank account details during the online checkout, await for the money to arrive and ship the goods or provide the service.

Of course one could claim that taking bank transfers is not truly a way to take payments online, as the actual payment is 'disconnected' from the ordering of goods. There is no instant payment confirmation at the time the order is confirmed.

However, if we would take this approach then we should leave out numerous other alternative payment methods as well, such as Boleto in Brazil and Pago Facil in Argentina. These payment methods are similar as the customer selects the way of payment during checkout, however completes payment at a later stage. Sometimes the actual transaction even takes place in a point-of-sale environment like a grocery shop or ATM location. These ‘online’ payment methods are still very relevant in some markets and not to neglect by merchants or business selling online. That's why we feel that traditional bank transfers are still relevant to mention as a way to get paid for goods and services sold over the internet.

Note that most Payment Service Providers (PSPs) also enable merchants to accept bank transfers. Most often in a more sophisticated and market custom way. They can consolidate the funds of bank transfer payments with other accepted payment methods funds. That makes life easier for merchants and businesses.

Merchant considerations for using bank transfers »

2. Through a direct integration with a Payment Method or Payment Solution.

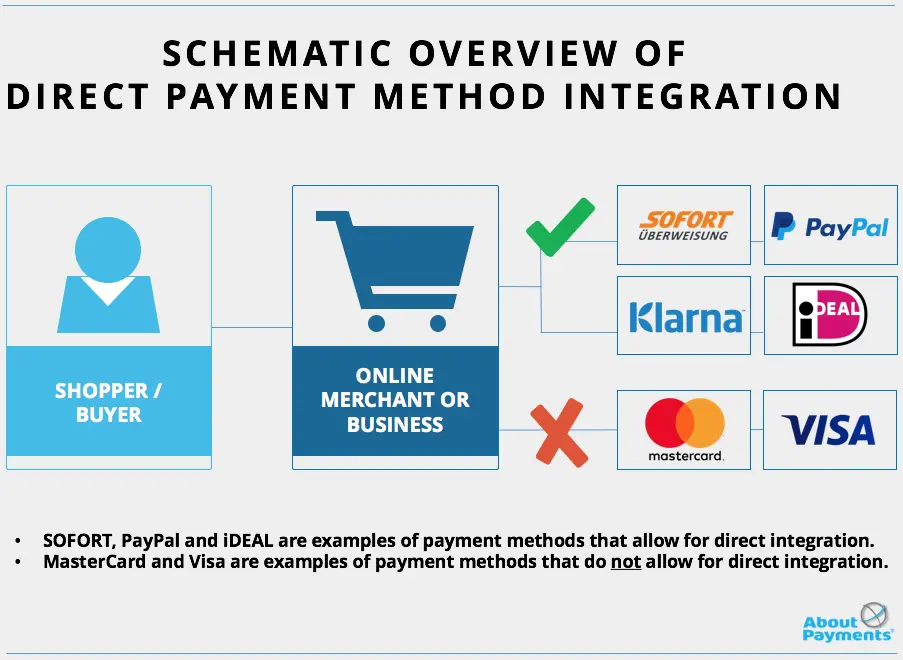

Across the globe, there are many online payment methods and solutions which allow for direct integration, such as PayPal, iDEAL, SOFORT and Klarna. Merchants are able to make a connection to the processing platforms of these payment methods directly from their website.

By doing the integration yourself, there is no need to use a third party payment processor or Payment Service Provider. The technical connection often can be made through API or SDK integration, or through so-called shopping cart 'plug-ins'.

These plug-ins are predefined and tested pieces of coding for shopping cart software like Magento, WooCommerce and Opencart. Especially merchants and businesses using the standard shopping cart (so no customization) can easily connect to the payment method scheme by using these plug-ins.

The payment methods which are open to direct integration often have a developer friendly section clearly indicating the supported plug-ins, and API and SDK documentation. Often there is a test environment available allowing you or your developer to test the processing connection and exchange of data.

Important note on the acceptance of credit cards.

Merchants and businesses looking to accept credit card brands like MasterCard and Visa should be warned that a direct integration with these card schemes is impossible to make. Both MasterCard and Visa work only with licensed card processors, acquirers and Payment Service Providers who enable merchants to accept card payments.

In other words, merchants who would like to accept MasterCard and Visa online are forced to use the services of a 3rd party processor or Payment Service Provider. For more information on credit cards, check out 'the credit card ecosystem' and 'how to accept credit card payments online'.

As credit cards often take a fair market share and many merchants rely on their acceptance, they should use the services of Payment Service Provider or tap into solutions like the PayPal merchant gateway allowing them to take cards over the internet.

Merchant considerations for using direct integrations »

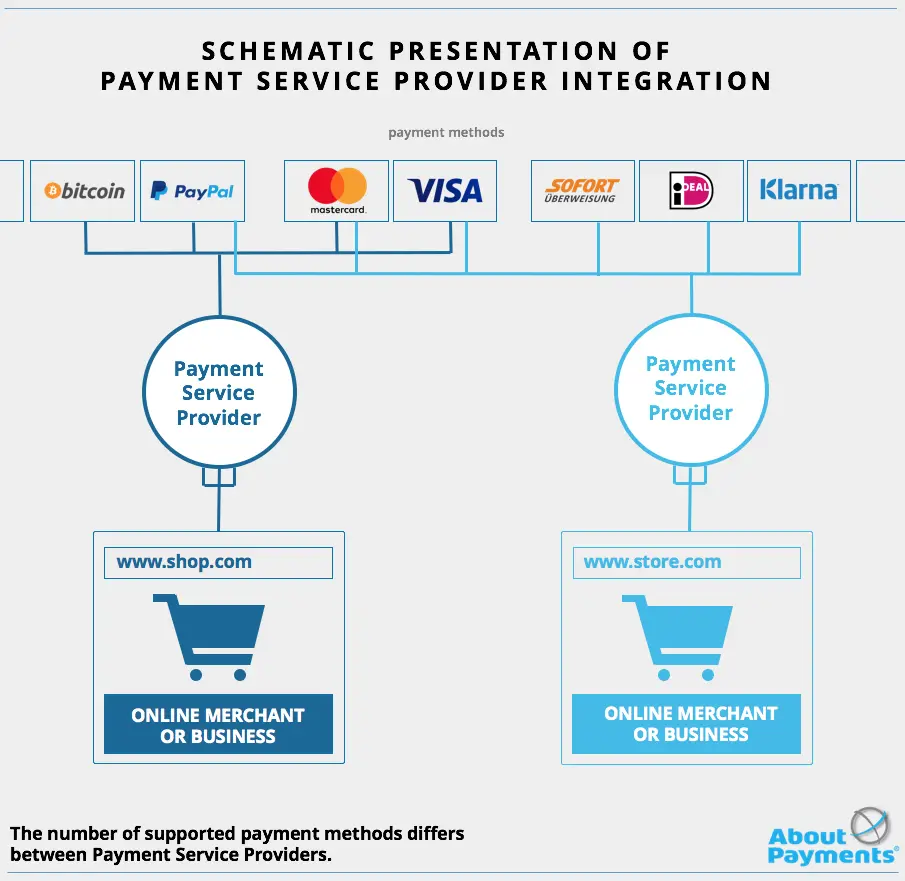

Payment Service Providers - sometimes also referred to as payment gateways - enable merchants to accept multiple payment methods through one single integration. The abbreviation for Payment Service Provider is PSP.

Payment Service Providers build and maintain the processing connections to individual payment methods and solutions on behalf of online merchants and businesses. They connect to payment methods like SOFORT, Klarna, MasterCard, Visa, PayPal, Alipay and iDEAL.

Every Payment Service Provider has its own number of connections and payment methods depending on the countries and regions their merchants are targeting. Some Payment Service Providers act local, regional or global. Click here if you want to compare Payment Service Providers and find one for your business.

Merchants and business can simply connect their website to the payment processing platform of the Payment Service Provider. Please see below a schematic presentation.

Continue here for more information on the types of Payment Service Provider integrations.

Besides their market span, we also distinguish Payment Service Providers based upon their ability to collect and settle money (from payment method schemes) to merchants. We recognize 2 different types: distributing Payment Service Providers and collecting Payment Service Providers.

Besides payment processing, Payment Service Providers offer additional services like reconciliation and fraud prevention tools, which help merchants to reduce the amount of resources needed for administration or fraud prevention.

Merchant considerations for using a Payment Service Provider »

Ecommerce platforms are the ones who provide a set of ecommerce services to merchants and people looking to start selling online, such us domain hosting, web design (skins), shopping cart systems, marketing tools (SEO optimization, email marketing) and online payment acceptance.

Most often these commerce platforms, like Shopify, Wix, MyShop have pre-integrated their platform with one or more Payment Service Providers or payment methods or solutions. On behalf of the merchant, they take care of building and maintaining the connection and simplify the acceptance of payments for merchants.

In some cases they allow merchants to choose and contract their Payment Service Provider of choice, sometimes they provide an all-in-one solution where there is no room for choice. The commerce platform itself has negotiated transaction fees with an particular Payment Service Provider or payment method scheme. The Payment Service Provider then effectively 'white labels' its payment processing platform.

Ecommerce platforms are the ones who provide a set of ecommerce services to merchants and people looking to start selling online, such us domain hosting, web design (skins), shopping cart systems, marketing tools (SEO optimization, email marketing) and online payment acceptance.

Most often these commerce platforms, like Shopify, Wix, MyShop have pre-integrated their platform with one or more Payment Service Providers or payment methods or solutions. On behalf of the merchant, they take care of building and maintaining the connection and simplify the acceptance of payments for merchants.

In some cases they allow merchants to choose and contract their Payment Service Provider of choice, sometimes they provide an all-in-one solution where there is no room for choice. The commerce platform itself has negotiated transaction fees with an particular Payment Service Provider or payment method scheme. The Payment Service Provider then effectively 'white labels' its payment processing platform.

Back to article index

Back to article index