Probably the most easy way of selling online and letting customers pay for goods or services, is by having them transferring money into your bank account. Below you can read about the pros and cons of accepting bank transfer payments and what to take into consideration.

This article is part of the 'how to accept payments online' series.

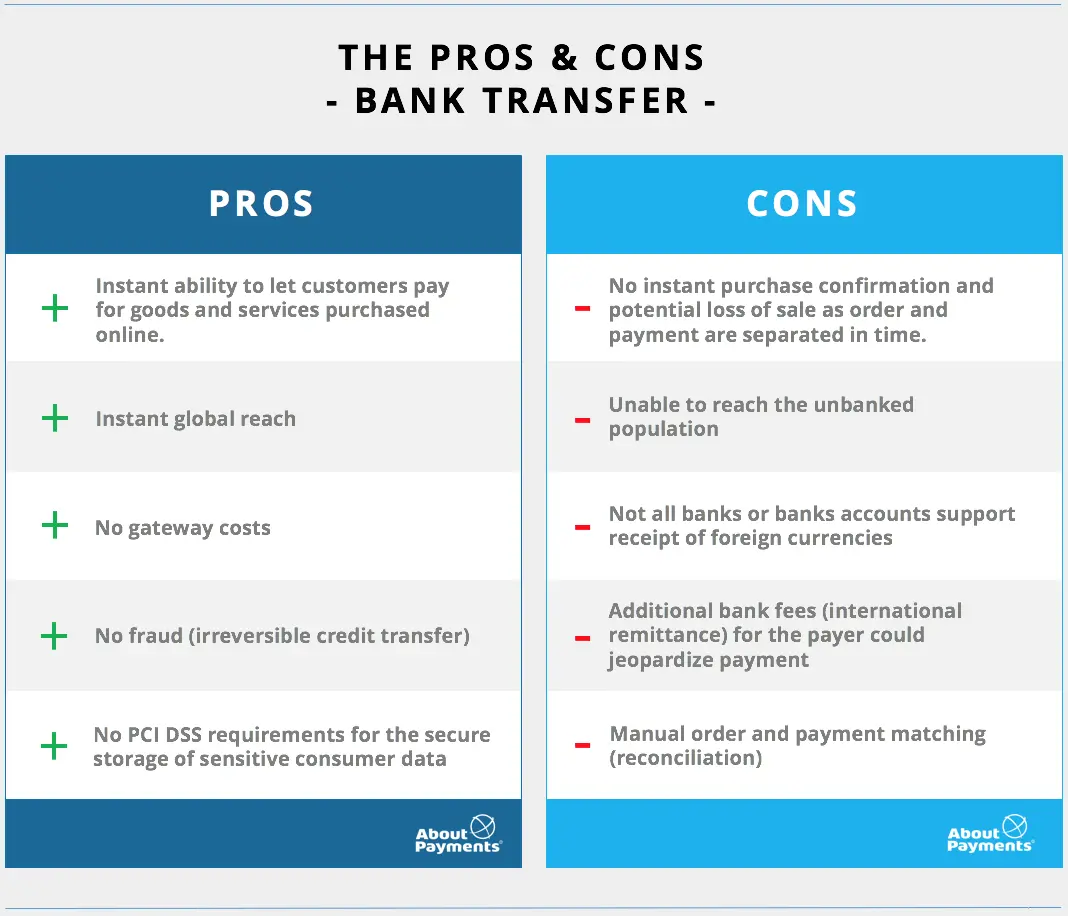

The Pros

The bank transfer payment option has a substantial global reach and allows you to instantly tap into many markets and consumers.

The fraud and chargeback risk is nihil as the bank transfer is initiated by the customer. It is credited from their bank into your bank account. Due to bank authentication requirements it is very hard to commit fraud, and even if so, you won't be hold responsible. So, in its core principle, a credit bank transfer is irreversible and guaranteed.

Other advantages include the fact that you do not have to pay for 3rd party processing costs. Only the cost of your bank for receiving money and for foreign currency exchange will be applicable.

There is no exchange of sensitive customer financial information (like credit card data) which you need to protect. So no PCI DSS requirements are applicable and no costs have to be made for safeguarding bank transfer data.

The Cons

Probably the most important downside of bank transfers is that the online purchase is not instantly confirmed by actual payment. The customer needs to take action and that in itself creates a dependancy or 'opt-out window'. Expected done deals could still end up in non payment and a non sale.

Not all banks and countries do allow for international remittance of funds. In addition, customers could face additional bank fees or charges when transferring money domestically or internationally. If not at the first payment, it could create a future burden for consumers and prevent them from coming back for successive purchases.

Some countries - especially in Latin America, Asia and Africa - still have a huge population with no access to banking products. Depending on your target markets, it could be relevant to have alternative payment options available as well to turn these unbanked shoppers into buyers.

Last but not least, online merchants and business should understand that not every shopper wants to pay through a bank transfer. It urges them to pay upfront for goods or services not yet received. Bare in mind that anxious customers - who might have little experience with buying online or are not familiar with the services of your company - simply opt out and buy at your competition. That's why we always recommend to have more online payment options available than bank transfer only.

Continue to 'how to accept payments online' »

Back to article index

Back to article index